-

Let us know what kind of mortgage or loan you currently have

-

Add scenarios

Like additional repayments,

loan term adjustments or

revaluation of your house. -

View the impact of each scenario and plan your repayment

By making an informed decision,

you will save a lot of money.

Calculate and Plan the Repayment of Your Mortgage or Loan

Recently Created Calculations

To determine your type of repayment method, review your loan agreement or statement, which outlines the terms and schedule of your payments. Look for details such as whether your payments are fixed or variable, and if they include both principal and interest, indicating an amortizing loan. Check for information on interest-only payments, where only the interest is paid initially, with principal repayments starting later. Balloon payments will be indicated by smaller periodic payments with a large lump sum due at the end of the term. If you are uncertain, contact your lender directly for a clear explanation of your repayment structure.

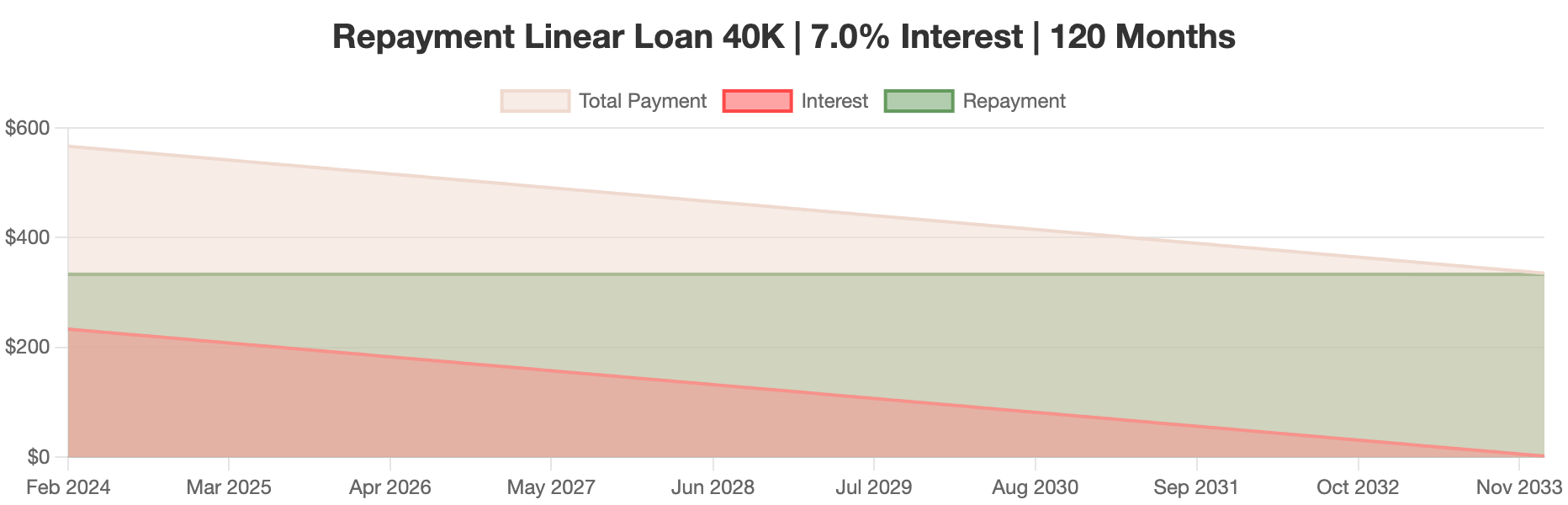

A linear loan is a type of fixed-rate loan where the principal is repaid in equal installments over the life of the loan. This results in a declining interest expense since interest is calculated on the outstanding principal, which decreases with each payment. Consequently, the total payment (principal plus interest) reduces over time, making it a predictable and straightforward repayment plan. Linear loans are often used in mortgage financing and can provide borrowers with the advantage of decreasing monthly payments as they progress. This type of loan structure contrasts with annuity loans, where payments remain constant throughout the loan term.

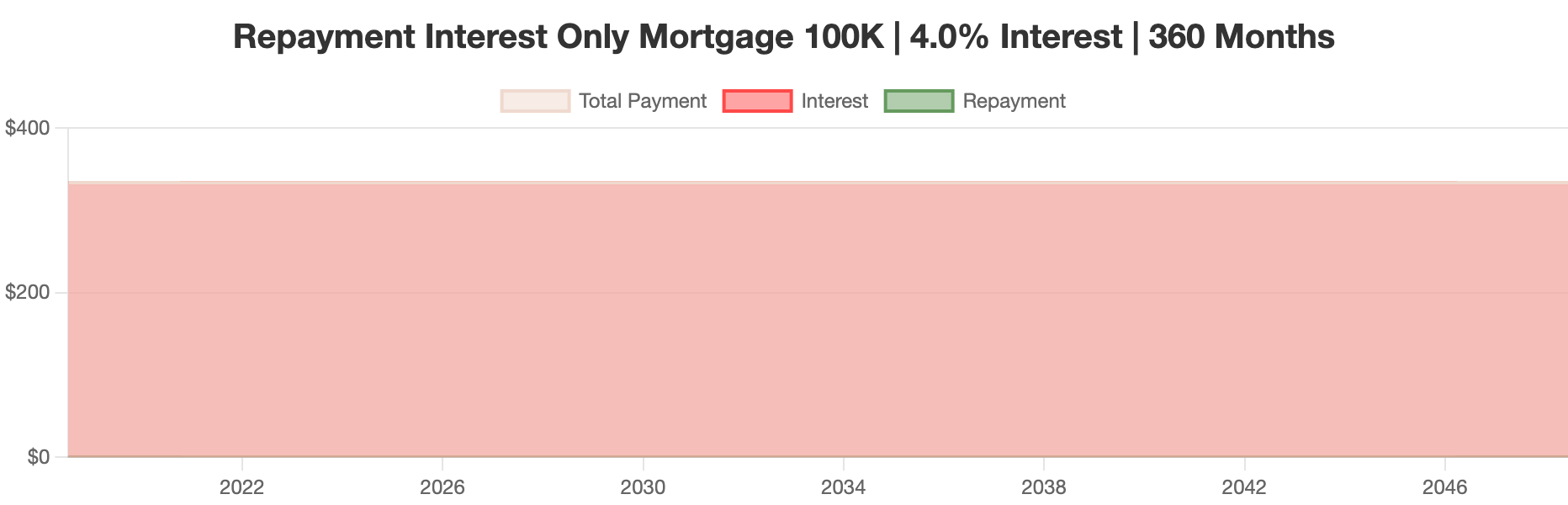

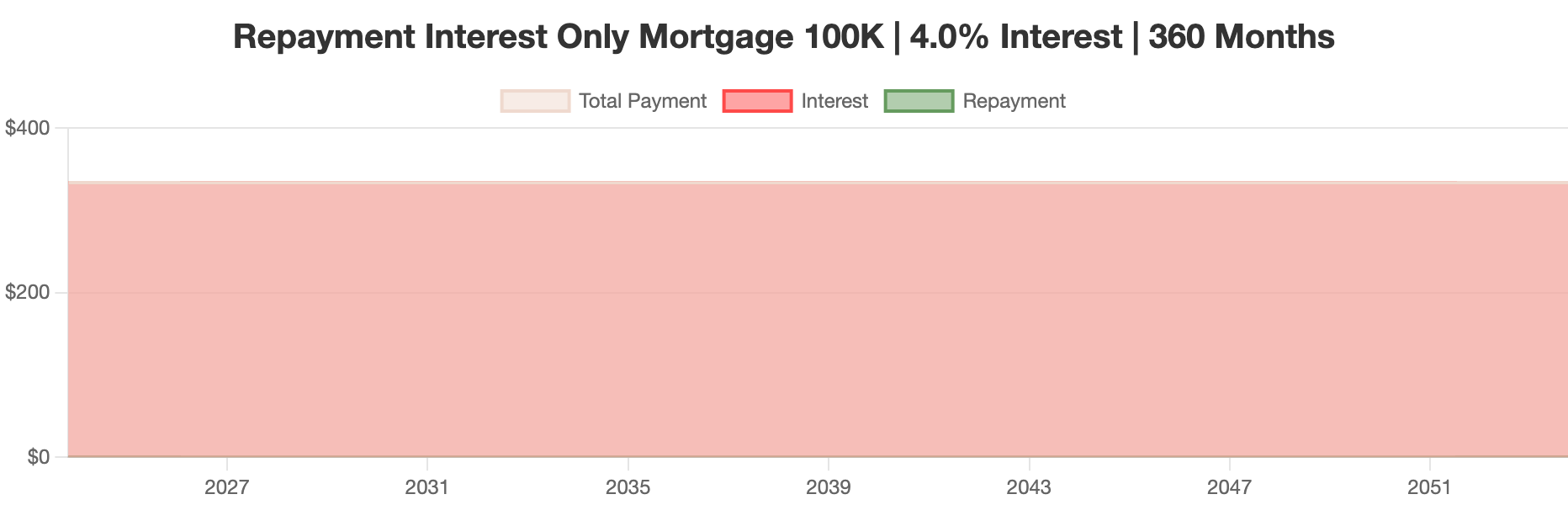

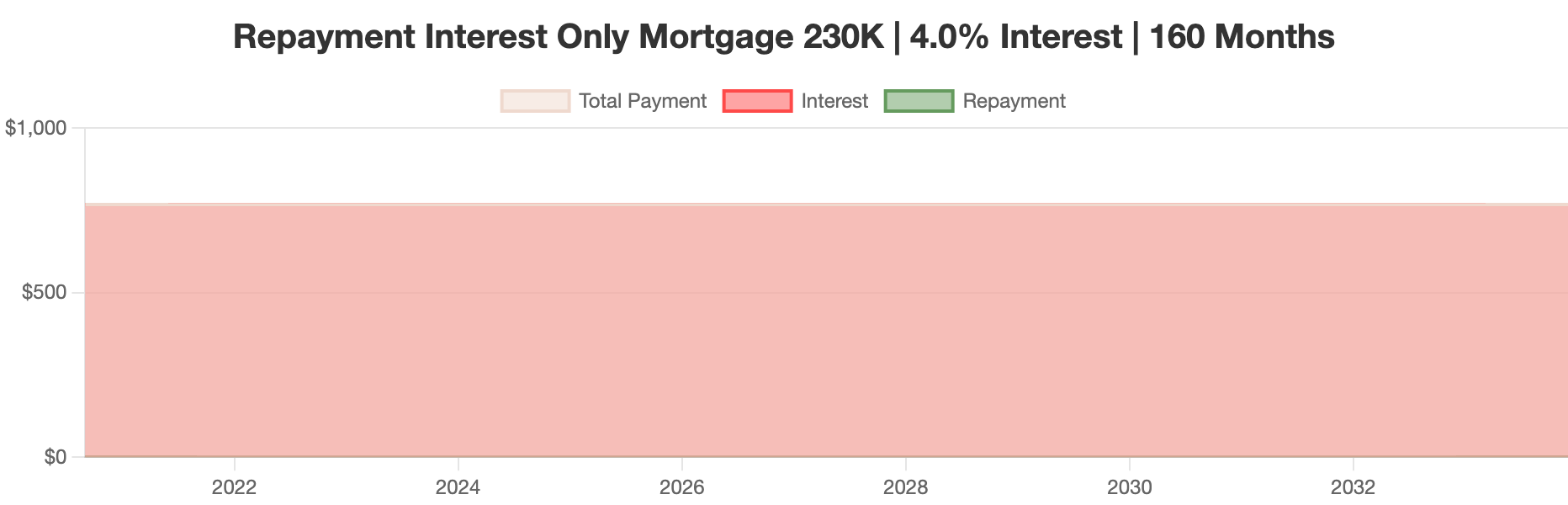

An annuity-based mortgage or loan involves fixed, periodic payments that cover both interest and principal over the loan term. Each payment amount remains constant, but the proportion of interest and principal within each payment changes over time. Initially, a larger portion of the payment goes towards interest, with the principal portion gradually increasing. This structure ensures that borrowers pay a predictable and stable amount each period, simplifying budgeting and financial planning. Annuity-based loans are commonly used for mortgages and other long-term loans, providing consistent payment schedules for the borrower.